IFTA Quarterly Fuel Tax Reporting

The Easiest Way

to Get Your Fuel Taxes Done. Period!

Spend less time filing fuel taxes and more time on the road. Total IFTA is the simple IFTA solution for drivers, built for speed, accuracy, and ease of use.

Regardless of the size of your organization, Total IFTA helps you process your IFTA reports in minutes – without the headache.

Full Featured IFTA Fuel Tax Reporting Solution

Everything you need to complete your IFTA Fuel Tax Reporting requirements quickly, and affordably!

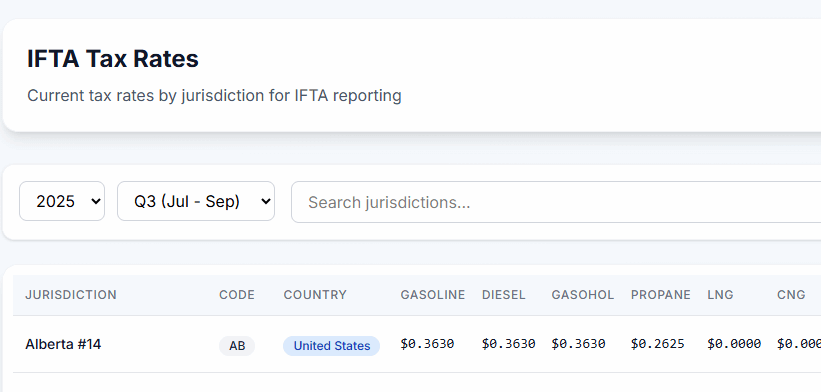

Fuel Tax Rates

Fuel Tax Rates, Surcharges and Intermittent Rate Changes are automatically downloaded and recorded ensuring your report calculations are always accurate, up to date and ready to file!

ELD Integration

Easily import quarterly miles traveled and fuel purchased for each of your fleet vehicles using our ELD Integration. Using this technology, we are able to pull data directly from your company ELD.

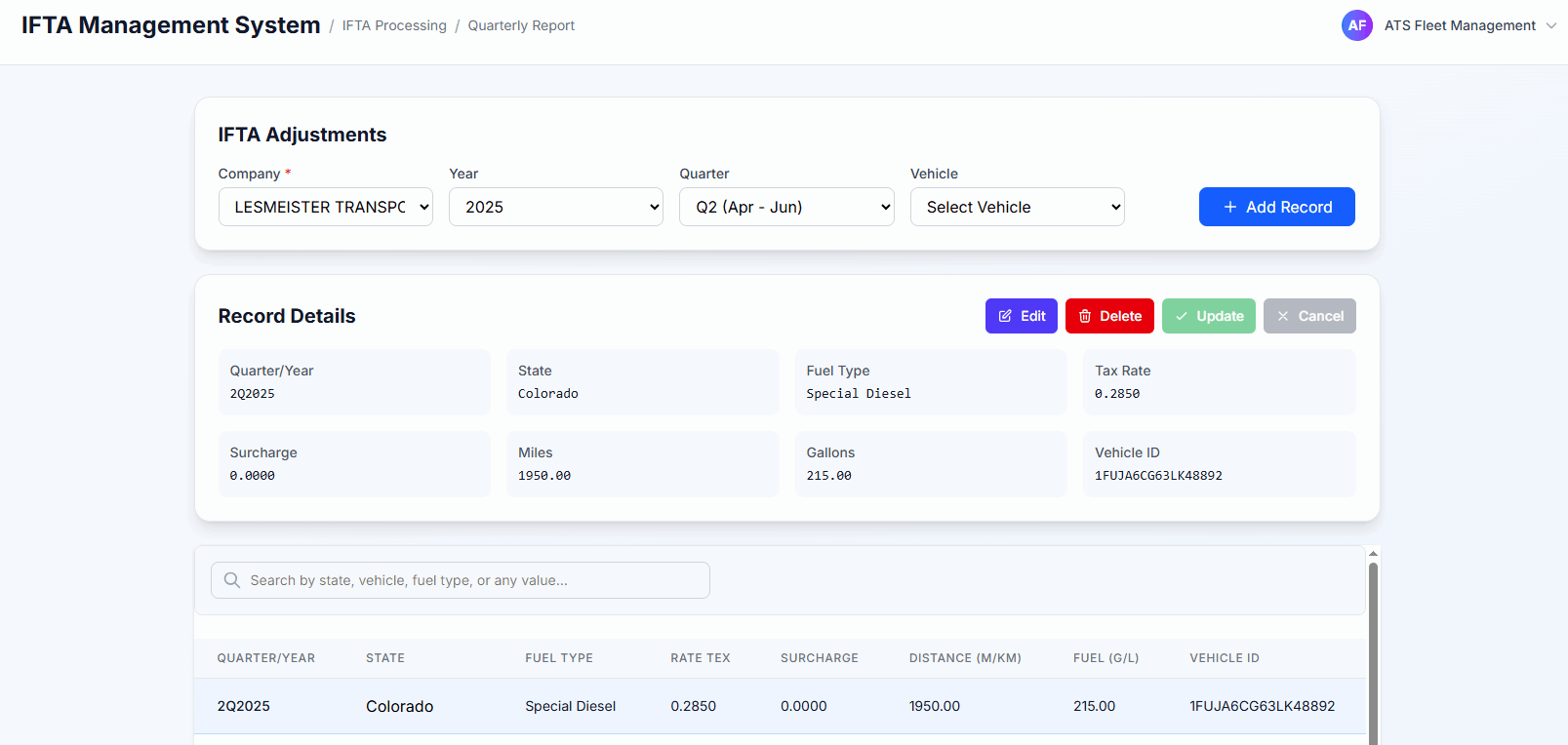

Mileage and Fuel Adjustments

An Adjustment feature and Mileage Calculator lets you make changes to your report detail when necessary to ensure your reporting is as accurate as possible when filing your fuel tax reports with your home state.

Key Features of Total IFTA Qtrly Reporting

Easy Data Integration

There are many ways to import State Mileage and Fuel Purchase detail into the Total IFTA Solution, making completing Fuel Tax Reporting a breeze!

Time Consuming

Using our proven solution, you are easily able to complete your Quarterly IFTA Fuel Tax Reporting Requirements quickly, saving you lots of time and money!

Single Button Click Reporting

Once data has been entered for your fleet, IFTA Reporting can be accomplished with a single button click. IFTA Reports produced can then be used for your quarterly filings.

Reporting and DOT Compliance

IFTA Quarterly Reports must be kept on file for 4 years. However, the system retains IFTA Reports indefinitely to ensure DOT Compliance is fully maintained.

Advanced Toolset

IFTA Adjustment and Mileage Calculator features lets you easily adjust mileage and fuel purchases ensuring all quarterly reporting detail is accurate!

IFTA Hotline & Unlimited Support

Using our IFTA Hotline and Unlimited Support features, help is always at your fingertips when you need it most. Our experts are standing by to help!

Get Started Today!

Total IFTA is the most affordable, easy to use Fuel Tax Calculation and Reporting Solution on the market today!

We can process your IFTA Reporting for you or you can have access to the Portal yourself. Either way, it is the easiest way to get your IFTA Quarterly Fuel Tax Reporting finished on time!

There are two (2) options available. Pay $50 per quarter for 1 vehicle or save $50 by purchasing a full year of IFTA Service for $149

Sign-up today and see how your company can start saving lots of time and money!

Quarterly Update Service

.

$50

EACH QUARTER

INCLUDED WITH SERVICE

- Quarterly Tax Rate Update

- Unlimited Cloud File Storage

- Free Software Updates

- Access to the IFTA Hotline!

- $5 Each Additional Vehicle

YEARLY Update Service

Save 25%

$149

Per Year

INCLUDED WITH SERVICE

- Quarterly Tax Rate Update

- Unlimited Cloud File Storage

- Free Software Updates

- Access to the IFTA Hotline!

- $15 Each Additional Vehicle

Built for Resellers, Owner-Operators

& Fleets of All Sizes

We created Total IFTA to take the stress out of quarterly tax filing for those who don’t have time to waste. It’s the best IFTA software for owner-operators and an ideal solution for small trucking companies looking to stay compliant without hiring a tax service.